sebab bila time nk explain, kekadang masa org tu tak sheshuai..

[nota: entry dgn unsur teknikal. jika nak fengsan. better stop eheks. btw, this is just my personal opinion based on attending the course related to this issue. ]

++++

so sms asal die berbunyi:

"Yg invest rm100 every month tu sampai brape lame? yg rm1000 tu skali setahun ke camne?"

"RM1000 tu utk bukak account, top up anytime MIN RM100. Kenapa berminat kah?"

"Hmm tak tahu lah. ada org kate baik lg simpan kat AS'B. guarantee deposit, safe n return pun tinggi. Duit tak banyak so nk invest mana2 pun takut"

Info #1

but first of all, lets clarify the different between ASB and UT by PubMutual.

ASB is a fund manage by PN'B - by government obviously.

in other hand, over more than 20+ UT private company in Mesia, the no 1 currently biggest fund manage is PubMutual. and PubMut work hard to be the lead in this industry. (well mestilah saya ups sket; pilih tempat cari duit extra saya kan kan?)

obviously, PN'B (as for government generate money tools??) manage the biggest fund in this industry.

Info #2

lets have a look at ASB dividend and bonus for the past 15 yrs

•1993: Dividend=9.00, Bonus=4.50*

•1994: Dividend=9.00, Bonus=4.50*

•1995: Dividend=10.0, Bonus=3.00*

•1996: Dividend=10.25, Bonus=3.00*

•1997: Dividend=10.25, Bonus=1.25*

•1998: Dividend=8.00, Bonus=2.50*

•1999: Dividend=10.5, Bonus=1.50*

•2000: Dividend=9.75, Bonus=2.00*

•2001: Dividend=7.00, Bonus=3.00*

•2002: Dividend=7.00, Bonus=2.00**

•2003: Dividend=7.25, Bonus=2.00**

•2004: Dividend=7.25, Bonus=2.00**

•2005: Dividend=7.25, Bonus=1.75**

•2006: Dividend=7.30, Bonus=1.25**

•2007: Dividend=8.00, Bonus=1.00**

•2008: Dividend=7.00, Bonus=1.75**

*source from PNB and prospectus.

monolog: err nape macam makin kurang dividend and bonus PNB bagi..?

purata dalam 9-11% jer.. hmm last year 2009 plak: Dividenf=7.25, Bonus=2.00

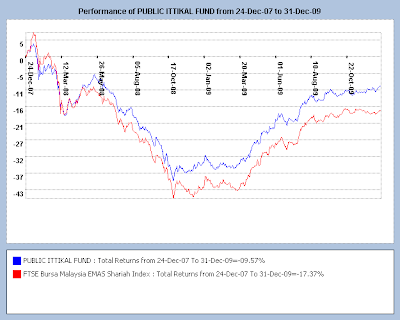

ok lets have look at this figure plak:

Figure #1

ok nampak tak? see the return after 6yrs?(Jan04 untill Jan2010) it is 86.15%itu saya just ambil utk 6yrs punya investment tru PMITTIKAL-FUND.

so if we divide 86.15%/6 = 14.3%

Info #3: some how, the return in UT average already beat ASB.

remember 3 rules investing in UT?

make it long term(MIN 3yrs), regular and asset allocation.

ok. now lets have a look at this figure. same fund, but i cut the range:

see how much did UT make? more than 40% returns!

if PN/B also invest during the same period, the also get 40% returns already, but why did they just declare the div+bonus=10% only?

PN/B also have to make money meh!

to give gov servants yearly bonus perhaps? but nan ado nya last yr! huhu

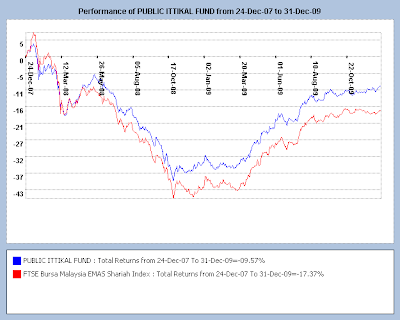

Figure #3

this time i cut the graph from 24Dec2007 until today date.

see the total returns is still in negative mode!

but remember the rules of investing in UT.

MIN 3 yrs investment!

perhaps, we should check again the returns after 24Dec2010 to see the total returns.

if PN/B also invest during the same period, the also get 40% returns already, but why did they just declare the div+bonus=10% only?

PN/B also have to make money meh!

to give gov servants yearly bonus perhaps? but nan ado nya last yr! huhu

Figure #3

this time i cut the graph from 24Dec2007 until today date.

see the total returns is still in negative mode!

but remember the rules of investing in UT.

MIN 3 yrs investment!

perhaps, we should check again the returns after 24Dec2010 to see the total returns.

semasa krisis ekonomi berlaku, ramai investor yg kuarkan duit, sbb takut makin rugi, but for those who did understand, they buy the UT some more in cheaper price. and that is how they make more money this year!

so if you dont want to get any headache about the market performance.

just stick with regular investment. make it Ringgit-Cost-Average!

just stick with regular investment. make it Ringgit-Cost-Average!

as for PNB, even the economy is down, they still declare quite good div+bonus last year rite?

but do we know, how much actually the return they get the previous year before market crash? say they gain more than this year perhaps 50%, they will keep the untung lor! just to make sure, they can top up the lost when market is down!

Info #4

UT have Islamic Fund

as for PubMutual the islamic fund 'ditapis' oleh ZIsyariah

saya pernah tanya kawan saya yg bekerja di Bank Islam tis simple question tru email:

salam UstZ, ada soalan ni..

btw hope ko n family sihat sejahtera...

Bank islam mmg tak jd agent ASB eh?

pastu apa pendapat ko pasal ASB?

ape plak pendapat ko dgn unit trust investing in Syariah Fund macam produk2 dari CIMB/ public-mutual plak?

and his reply:

w'slm...Alhamdulillah, sihat semuanya.....

Bank islam tak jd agen AS'B sbb panel syariah bank tu tak recognise yg AS'B tu 100% halal. yg nampak ketara adalah May'bank(majoriti pelaburan MB libatkan riba') still jd tpt pelaburan terbesar utk dana AS'B ni. kalau Maybank Islamic shj ok la.

yg ke-2, kalau tak silap PN'B tu sendiri tiada panel penasihat syariah. ini adalah asas utama dlm sesebuah organisasi/institusi islam krn segala hala tuju & perjalanan perniagaan akan di tapis terlebih dulu oleh panel syariah ni.kita sbg pelanggan pun akan berasa yakin utk melabur apabila panel syariah kata halal. betul tak?

thats why smpai skrg aku pun tak invest dlm ASB. psl unit trust ni, tak salah utk melabur dgn syarat kena melabur dlm instrument2 islamic shj la. dlm CIMB/Public mutual dll mmg ada instrument2 konvensional & islamic. psl list unit trust yg halal boleh semak dlm web IBFIM....

ok, skrg ni aku pulak nak tanya, bila ko nak kahwin? (soklan maut ni)...hehehehee....

errr Apekah?

So in UT, for investment less than 3 yrs, we are not losing money, but not yet making money!

Info #6 can i say SAFEly islamic

tepuk dada tanye selera.. again this is my personal opinion in my personal blog...

p/s: as for me, dah tak simpan di ASB lagi, tapi memilih UT Islamic Fund!