Alhamdulillah Syukurlah

(kire lepaslah duit modal saya p amik test UTC/attend course/duit minyak/duit borang etc .. yer work as UTC ni based on komisyen yg ciput; itu pasal saya tade cadangan pun nk buat fulltime; but oklah as part timer yg berminat nak cari ilmu tentang investment!)

so skrg saya nak cerita pasal Common Mistake investors make that can hurt the performance of their portfolio:

(saya akan cuba cerita based on pengalaman peribadi saya sendiri utk entry ni nampak lebih realistik gtu!! erk apekah??)

(Warning: entry ni sedikit memboringkan... sbb seriously saya dalam mood boring skrg ni T__T)

so back to topic title 'Avoiding Common Pitfalls of Investing' quote from feature BuletinUTC Jan2010.

#1 Not preparing emergency funds before investing

invest tanpa allocated emergency funds umpama masuk water rafting tanpa pakai life jacket! seorang investor disarankan untuk bersedia dengan sekurang2nya 3-6bulan perbelanjaan bagi sebarang kes melibatkan financial emergencies (such as job loss) or unexpected cash flow probs.

asasnya disini, supaya kita tidak berasa kurang stabil emosi dan fizikal semasa berdepan dengan masalah peribadi seperti ini.(

berhutang untuk melabur bukanlah pilihan yang bijak!

tapi anggaplah investing in UT sebagai cara utk menyimpan utk keperluan masa depan#2 Market timing

walaupun pasaran saham dikatakan move in cycles, this does not necessarily mean that we can determine when to enter and exit the market at its lows and peaks respectively!

successful investors seperti Warren Buffet sendiri tidak menggunakan kaedah market-timing ini kerana more often that not, do not work!

so ape lagi kite yg kekadang tiada mase nk monitor pasaran saham semasa; jadi adalah lebih baik serahkan all the hassle kepada FundManager(yg kita dah bayor servisnya dlm %service charge itu) utk memastikan keuntungan investment dalam jangka masa yang sederhana/pjg tercapai!

sebenarnya semasa saya menghadiri kelas bersama GAMSeanTan itu; ive gotto agree those market shares performance sometime more on speculation. tapi ia turut memahamkan saya bahawa pasaran yg merudum adalah peluang untuk making money dalam UT investment!!

#3 Procrastination

Investor should not delay or posponed action when investing because an early start can make a world of difference in the potential returns as a longer time horizon will allow compounding interest to work effectively.

senang kata; semakin lambat kite delay/tangguh utk memulakan investment, semakin banyak duit yang diperlukan untuk mendapatkan pulangan keuntungan yang sama dengan those who started investing earlier..

#4 Taking too much or too little RISK

remember High Risk High Return; however high-risk takers often end up as speculators and often make investments without conducting prior research. so, instead of merely relying on your risk tolerance to shape your investments, you should also take into consideration your financial goals and time horizon.

~jangan bermain dengan risiko.. tapi cubalah memahami risiko tersebut! risiko dalam pelaburan occay!

#5 Lack of diversification

dont put all eggs in one basket! A well diversified portfolio will adhere to all components of asset allocation - considering risk tolerance, investment capital available, investment time horizon and the current portfolio's asset class weightings.

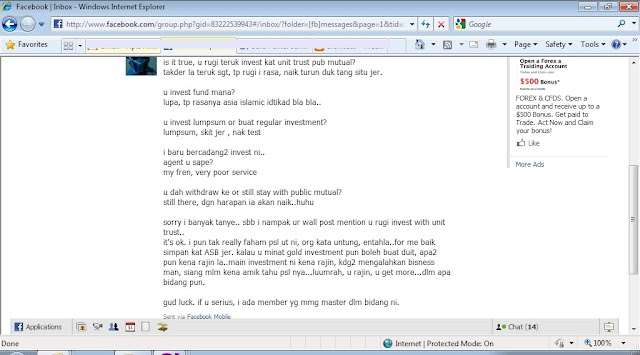

#6 Becoming emotional in investment decisions

Kebanyakan investor tersilap membuat pelaburan bila mereka mencampur adukkan perasaan TAMAK atau TAKUT dalam menentukan keputusan pelaburan mereka. sepatutnya mereka harus bersikap objective dan rasional dalam menilai pelaburan yang dilakukan.

#7 Lack of research

Investors should do their homework before investing. Succesful investing requires on-going time and effort, which includes investors conducting their own investment research.

Investor should also take note that past performance of an investment is not an indication of future performance.

did some research on any investment that you would like to make. especially skim cepat kaya!!

#8 Panicking during bear markets

seperti #6 dont let you emotion lead you in investment. if you make your investment long term, this season bear markets create opportunity to accumulate good stocks at attractive prices.

Everyone make errors in their investments but what separate the winners from the losers?

it's the one who apply what they learn from their mistakes.The key to successful investing is not to avoid risk altogether but to recognize the risks you are taking. To avoid unpleasant surprises, do your homework.

Everyone makes mistakes one time or another. As investors, we need to learn from our investment mistakes by recognizing them and making the appropriate adjustments to our investing discipline.

So? Always learn from your mistakes!

p/s: this entry suitable for any type of investment that you are in to!

p/p/s: jadikan kesilapan itu suatu pengajaran... tetibe terase nak nyanyi lagu 'Suratan atau Kebetulan'

~walau kita dihadapkan dengan pelbagai pilihan,

mengapa sering terjadi pilihan tak menepati,

hingga amat menakutkan menghadapi masa depan,

seolah telah terhapus sebuah kehidupan yang kudus....